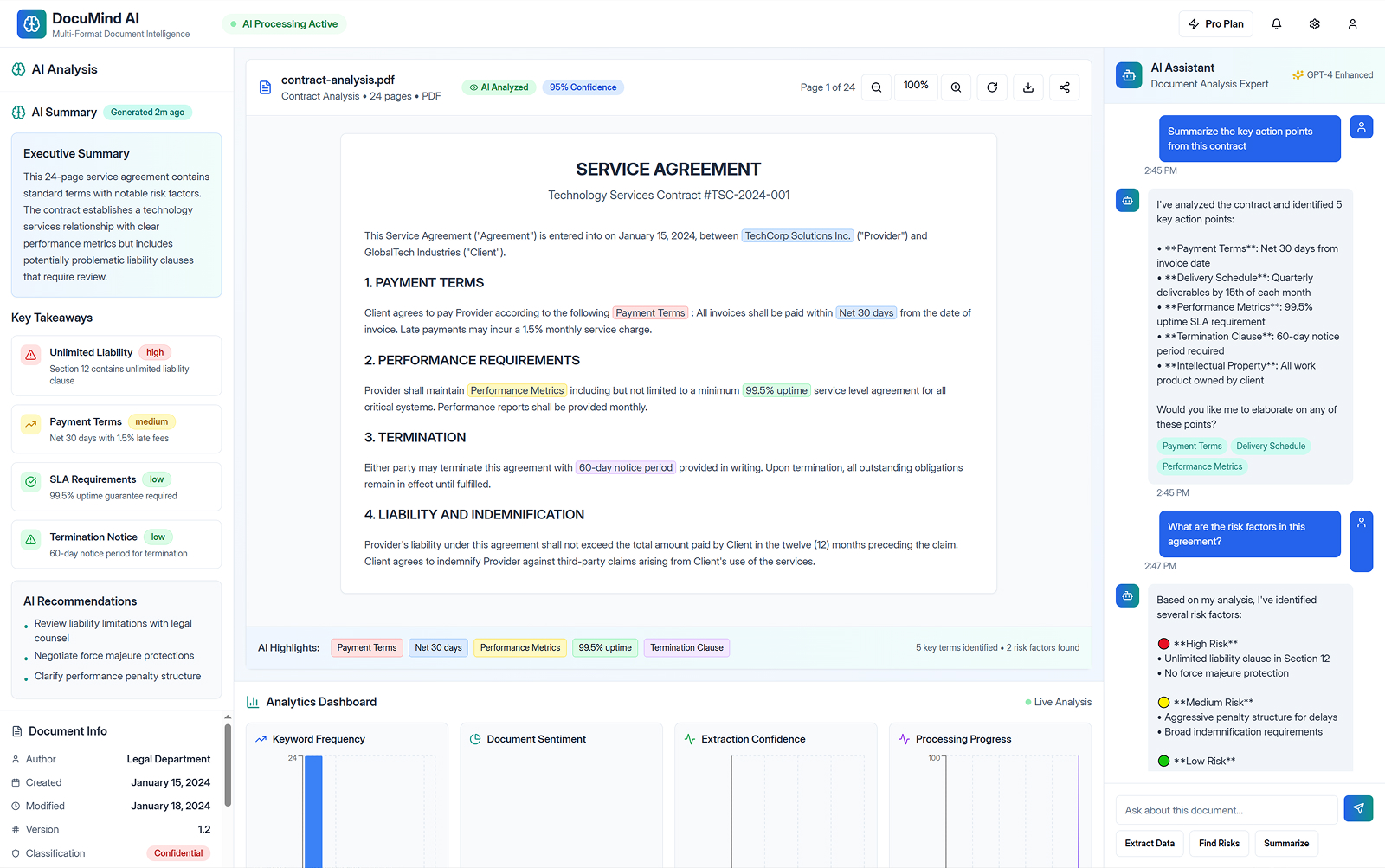

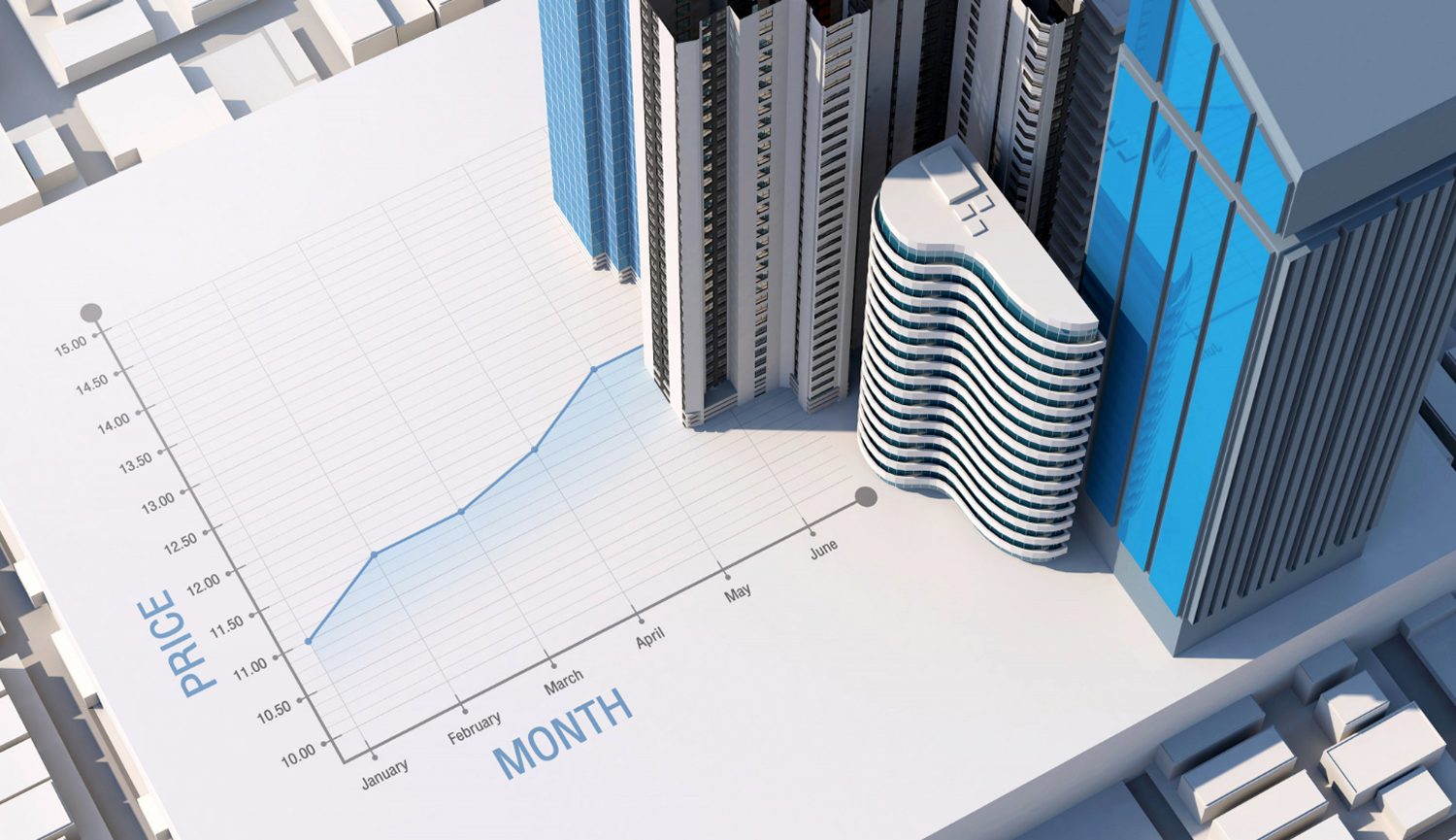

Finance & Banking

We build secure, compliant, and scalable digital solutions for banks, fintech startups, and financial institutions. From mobile banking apps to AI-driven fraud detection systems, our technology helps you innovate faster while maintaining trust and regulatory alignment. Whether you're modernizing legacy systems or launching new financial products, we enable smooth, secure, and future-ready digital banking experiences.

Book a Consultation Call Book a Consultation Call